Are Business Meals Draining Your Finances More Than You Think?

When it comes to deducting meal expenses, the general rule of thumb is that you can deduct 50% of the cost. For example, if you spend $100 on a lunch with a client, your tax deduction is limited to $50. However, it's important to remember that the actual cash savings come tax time can be even smaller.

Understanding the intricacies of tax deductions is crucial for small business owners, especially when it comes to something as common as meals. While enjoying a business lunch can be enjoyable, optimizing your tax strategy to include meal deductions requires a clear understanding of the potential benefits and risks involved.

Calculating Your Savings

Let’s break this down with an example:

- As a small business owner, if you claim $500 in meal expenses on your tax return, this results in a $250 deduction, due to the 50% rule.

- If your effective federal tax rate is around 12%, the $500 deduction translates to approximately $30 in tax savings.

Given this scenario, it's crucial to assess whether the $30 savings justifies the effort involved in maintaining records and receipts for these expenses, not to mention potential risks involved.

Assessing the Risks

When considering meal deductions, it's also vital to weigh the potential risks:

- Keeping detailed records: You'll need to meticulously document the business purpose of each meal, which can be time-consuming.

- Risk of audit: If your meal expenses are higher than usual in your industry, it might raise red flags with the IRS, increasing the chances of an audit.

- Impact on financials: Banks and lenders scrutinize your financials, and extensive meal deductions might not portray healthy cash flows if you're seeking funding.

Making Informed Decisions

Ultimately, you need to assess whether the potential savings are worth the risks and additional work. Ask yourself:

- Is a $30 tax saving significant enough to warrant the documentation and potential audit risk?

- Even if the savings were $100 or $200, would it outweigh the potential downsides?

Entertainment Expenses: No Longer Tax-Deductible

Unfortunately, following the 2017 tax law changes, entertainment expenses are no longer deductible when you file your business taxes. This means that hosting clients at an event, even if it results in establishing a valuable business relationship, won’t provide any tax relief on your return. It might come as a surprise, and it's crucial not to blame your accountant when you notice higher taxable income due to these changes. That's not to say that you shouldn't entertain your clients. It could result in a long-term, profitable relationship. Just weigh all of the factors when investing in those entertainment opportunities including the cost of the event, lack of tax savings, and anticipated return on your investment for the event.

Food Expenses: An Opportunity for Tax Deductions

That said, there is a way to leverage your business gatherings for some tax savings. While the cost of the game box or event tickets isn't deductible, ensuring the food served is invoiced separately opens up an opportunity. You can deduct 50% of the food costs, as long as the documentation is properly handled.

Accountable vs. Non-Accountable Plans - Understanding Compliance Issues

The IRS has defined two ways to handle meal expenses for employees: accountable and non-accountable plans. For a smoother, IRS-compliant approach, an accountable plan is the way to go.

-

Accountable Plan: This involves maintaining receipts for business purchases, including business meals. Documentation is key, as the traceable receipts provide evidence for deduction purposes. Include the date, attendees, and business topic discussed on your receipt.

-

Non-Accountable Plan: Here, the employer gives cash to employees for meals without requiring receipts. This can lead to complications with the IRS, potentially resulting in the need to record these as taxable income on employees’ W-2 forms.

Avoid the hassle by adhering to accountable plans and keeping thorough documentation. This not only simplifies things for you and your business but also keeps your employees' tax situation straightforward.

Meal Write-Off Percentages

- Employee Meetings or Working Over-time (for convenience of employer) - 50%

- Business Meal w/ Client (if ordinary, necessary & directly related to business) - 50%

- Reimburse Employees for Business Meals (employees provide receipts) - 50%

- Reimburse Employee for Business Meals with no receipt, but include in W2 - 100% deduction (no deduction for employee and counts as wages, so FICA taxes paid on this by employer)

- Reimburse Employee for Business Meals with no receipt, not included in W2 - No Deduction

- Travel Meals (when traveling away from home for business purpose) - 50%

- Company-Wide Social Events (holiday party) - 100%

- Meals with No Business Purpose (occasional coffee, grabbing lunch while running errands) - No Deduction

- Truckers subject to DOT hours of service regulations - 80%

Resources

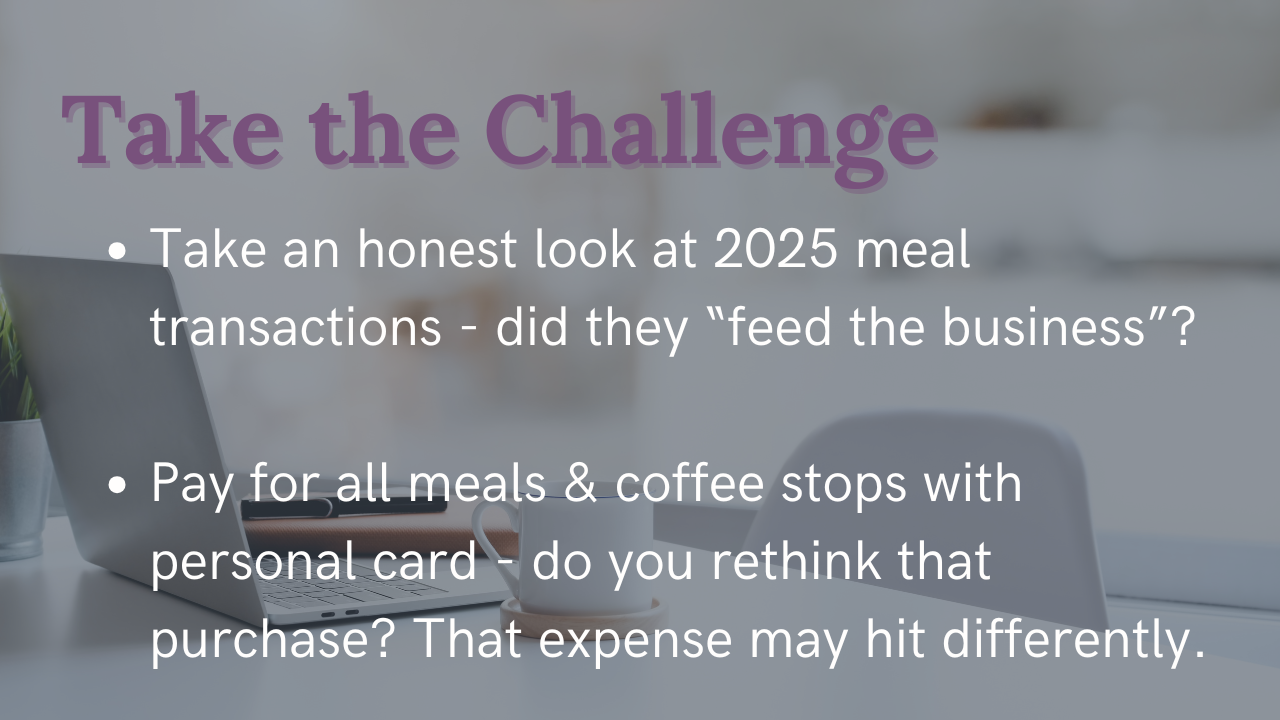

Spending time tracking and recording meals that have no real business purpose can cost you not only personal time, but accounting and bookkeeping fees. These transactions must be reviewed individually to determine whether they are fully deductible, deductible at 50%, or not deductible at all.

Take, for example, a business owner paying an effective tax rate of 12% with $500 of client business meals. Those meals result in a $250 business deduction ($500 * 50%) and $30 in federal income tax savings ($250 * 12%). I'll leave it to you to decide whether the $30 savings is worth your time and effort to track these, plus any additional accounting fees to deduct them properly.

Don't Just Take My Word For It

Check out these links for up-to-date information directly from the IRS and AICPA.

- Employer's Guide to Fringe Benefits

- IRS Publication 463 - Travel, Gift, and Car Expenses

- Tax Adviser - Substantiation of Busienss Expenses: A Review of the Basics

- Tax Adviser - Navigating Around Limits on Meals and Entertainment

- Tax Adviser - Business Meal Deductions After the TCJA

"Control your expenses better than your competition. This is where you can always find the competitive advantage."

-Sam Walton

Responses